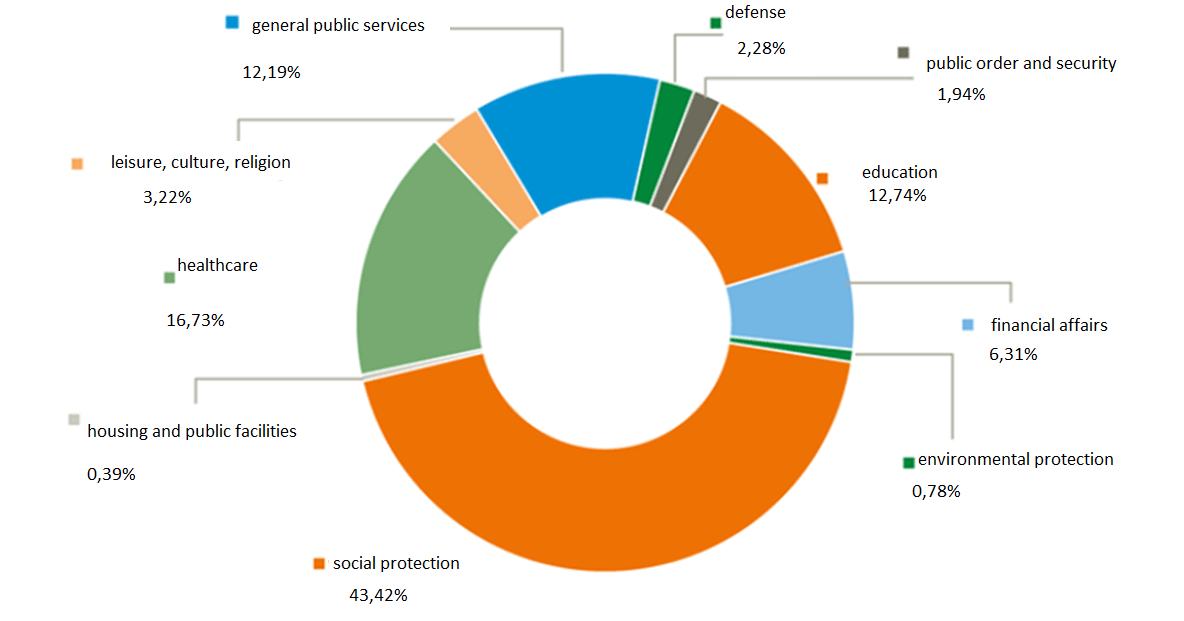

While the tax rates may seem high, they support essential public services like healthcare, education, and infrastructure. Here is an example of the distribution of 1 DKK:

The Danish tax system is progressive, meaning that higher income earners pay a larger percentage of their income in taxes.

Taxes in Denmark are deducted at the source, so employers withhold income tax (A-skat) from employee salaries. This system ensures that taxes are paid automatically, minimizing the risk of non-compliance.

If you’re new to Denmark or planning to work here, you will need to register with the Danish tax authorities and obtain a tax card. You can find more details on this process on our paperwork services page, which provides guidance on the administrative side of working in Denmark.

A tax card is a document issued by the Danish tax authority (SKAT) that your employer uses to calculate how much tax should be deducted from your salary. The card contains important information such as your tax rate and personal allowance. As an intern, your employer will use this tax card to ensure that the correct amount is withheld from your earnings.

All residents of Denmark are entitled to a personal deduction (personfradrag), which for 2025 amounts to DKK 51.600 This deduction applies to all individuals over 18 years old and is a tax-free amount of income.

For example, if you earn DKK 49,700 or less, you are exempt from paying income taxes. If you have a spouse, any unused deduction can be transferred to them, reducing their taxable income.

All working citizens in Denmark must pay labor market contributions - in Danish called arbejdsmarkedsbidrag. This is an 8% tax that employers deduct from your salary after all pension contributions have been made (including ATP-bidrag).

However, you do not have to pay the labor market contribution if you receive a scholarship, pension, state assistance, unemployment benefits, and other allowances. All of this should be reflected in your tax card to ensure your deduction (fradrag) is accurate.

A-skat (A-income) is the income tax deducted directly from your salary after accounting for the labor market contribution and your personal deduction. The tax rate in Denmark ranges from 37% to 53%, depending on your income and where you live.

If your annual income exceeds DKK 588,900 after the labor market contribution, you are required to pay an additional top-skat of 15%.

B-skat (B-income) is the income on which tax and labor market contributions (AM-bidrag) have not been withheld by your employer. This is usually if you work freelance or have been paid a fee for a job. It is your own responsibility to pay tax (B-Skat) and labor market contributions on B-income.

Every year, taxpayers in Denmark must file a preliminary income assessment (forskudsopgørelse) to ensure that their deductions and allowances are correctly calculated. This form, known as a Forskudsopgørelse, allows you to declare your expected income and deductions for the upcoming year.

Based on this information, your tax card is updated. Failure to file the correct information may result in over- or under-taxation, so it’s important to keep your tax card up to date.

For newcomers to Denmark, registration in the tax system is necessary, as mentioned above. If you already have a tax card and continue working next year, the tax authorities will send you a preliminary tax card, which you should review and add any missing deductions to.

For more information about internships and how taxes may affect your earnings, visit our internships in Denmark page.

Every year, from March to July, everyone in Denmark fills out an annual tax assessment notice. This document is a summary of your income, deductions, and taxes paid throughout the year.

You must verify the information and add any missing deductions, such as commuting expenses or student allowances. Based on this information, you will see your annual statement - red numbers indicating tax debt and green numbers indicating tax refund.

Typically, the money is deposited into your NEM account, provided you have no debts from previous years. Red numbers represent a debt, which you can pay immediately, in installments, or wait for SKAT to include it in your tax card for the following year (with a small percentage).

The tax percentage in Denmark is determined by several factors:

In total, the effective income tax rate can range from 37% to 53%, depending on your municipality and total earnings. The tax rates are set annually, so it’s important to check for any updates, particularly if you’re planning to move or have significant changes to your income.

Newcomers to Denmark are subject to the same tax rules as Danish citizens. However, it’s essential to ensure that your tax situation is correctly registered when you arrive.

If you’re coming to Denmark for work, you must obtain a tax card and keep track of deadlines for filing tax returns. Our team at WorkAdvice can help guide you through the process and ensure compliance with Danish tax laws - and we do so even before you arrive in Denmark.

You can explore more of our tax services here.

What is topskat?

Topskat is an additional 15% tax applied to income above DKK 588,900.